When you think about opening an eCommerce store, Shopify and Stripe are two popular payment service providers that come to mind first, right? Stripe can be a good payment service provider if you want to start small-scale businesses. However, Shopify has its own benefits. It’s a full-fledged e-commerce platform where you can create and run your own online store.

So, which of these proves to be a better solution? Well, our research will help you determine that through this comparison blog between Stripe and Shopify Payments. So what are Shopify Payments? Well, it is Shopify’s own payment service that helps you accept payments like Stripe.

But sadly, Shopify Payment is only available for Shopify Users. If you are a non-Shopify user, Stripe is a great option that provides high-level customization options and developer-friendly tools.

So, Let’s break down how they both compare regarding payment handling and pricing capabilities.

Key Takeaway :

Stripe and Shopify Payments are both popular payment service providers for eCommerce stores. Stripe is a good option for small-scale businesses and offers high-level customization options and developer-friendly tools. Shopify Payments is a full-fledged e-commerce platform that allows you to create and run your own online store and is a good option if you want something simple and fast. Ultimately, the choice between the two depends on your business needs.

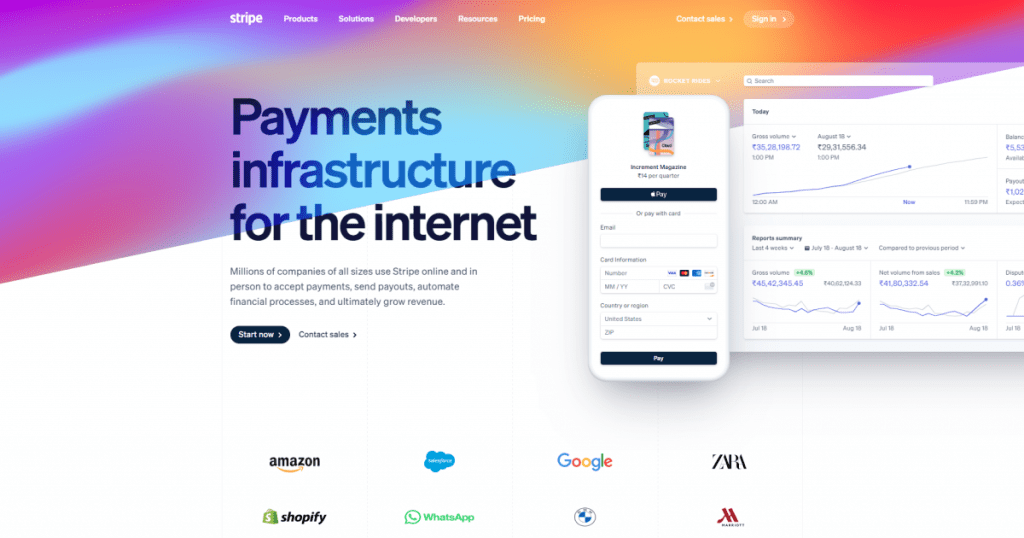

Overview of Stripe

Stripe is an Irish-American Financial Service firm based in California, United States. This company can help you manage finances by accepting and sending payouts to businesses of all sizes.

Stripe is an SCA-accredited payment service provider, so you don’t have to concern yourself over trust and reliability. Also, if you’re an online retailer, Stripe will help you accept international payments as well.

E-commerce store owners often prefer Stripe as it offers amazing features. For example, billing, invoicing, payment links, fraud and risk management, and subscription management. Besides that, you can create your custom payment pages with Stripe. There’s also a facility for online identification verification.

The benefits don’t end here! Stripe even accepts payments from a lot of offline modes, including POS, credit card, and debit card payments. Do you have a dedicated team? Stride can offer access to faster and more secure payment processing. It has various customization tools, Developer APIs, facilities to build apps, and even pre-made integrations. What else would you want?

By adding hundreds of improvements every year, Stripe stays updated to offer you the latest solutions. Also, it clearly shows their commitment to fast innovation. Moreover, Stripe promises 99.99% uptime for its systems, so you don’t have to be concerned about any losses.

Overview of Shopify

Surely, most of you would have heard of Shopify, a popular e-commerce platform. As we said in the introduction, Shopify can be a one-spot solution to all your needs, from creating websites to managing inventories and accepting payments, pretty much like , pretty much like SellVia and Pierta.

There’s a lot more! Shopify payment is alone sufficient to accept payment natively. You won’t have to integrate or face any hassles with third-party payment providers. Shopify payment is available in all of their plans, so even if you go with the Cheapest plan, you can access it right away.

So, if you are planning to set up Shopify payments, you’ll first need to complete the two-factor authentication and then follow the procedure. This is a very easy process, and it also helps to reduce your operating costs.

Thus, if you choose Shopify payments, you don’t have to pay any third-party transaction handling fees. This benefit is available for Shop Pay, Paypal Express, and Shop Pay Instalments. Moreover, there are no fees for manual payment modes such as cash or direct bank transfers.

We’ve narrated many guide for helping Shopify merchants:

- How to Add a video to Shopify Video Banner Section?

- How to Connect Shopify Forms to HighLevel

- How to Put Icon Images in Shopify Footer

Importance of Desku Integration

When using platforms like Stripe or Shopify, you can also integrate Desku with them. It can improve your customer support and operational efficiency by a large margin. By using Desku’s help desk tools, you can enhance communications and provide quick assistance. This will create an overall positive experience for your customers.

Integrating Desku with Stripe will allow your support team to solve payment-related inquiries easily. Centralizing support requests and payment-related issues can significantly reduce the time required to solve them. This will increase overall customer satisfaction.

When you use Shopify, Desku becomes even more useful by allowing you to combine customer support operations on the platform. With these Integration capabilities of Desku, you get a more coordinated way of handling inquiries, making sure that nothing slips through and all customer issues are solved.

When you integrate Desku with Shopify or Stripe, It will synchronize in real-time and provide your support agents with a broad range of information, which helps them provide faster solutions to customer issues and give them personalized help.

With the help of Desku, you can easily get analytics and detailed reports about current customer trends, support team’s performance, and much more. So, suppose you are already running a business from Stripe or Shopify. In that case, this data will be very useful when creating future plans, looking for areas to improve, and leveling up your customer experience.

Shopify vs Stripe: Features

Stripe Features Overview

If you want to use Shopify payments, you must buy a subscription to the entire Shopify platform. In comparison, Stripe can work with almost any platform (even Shopify).

Suppose you want to add digital wallets, such as Google Pay, Apple Pay, etc. Stripe will make it entirely possible for you. Also, even credit card payments, debit cards, and bank transfer payment gateways are present on Stripe.

Now, coming back to Shopify payments, it offers you a lot of pre-built features. We can group them into three major sections:

- Revenue and Finance automation: Invoicing, Billing, Tax automation, Stripe Sigma (custom reporting tools), Data pipelines, Atlas revenue recognition,

- Global payments: Subscription and billing tools, financial connections, terminal solutions, checkout management, online identity verification, online payment processing, customizable payment interface, payment links, payment platform connectors, fraud and risk management.

- Banking as a service includes card creation and connection tools that are useful for financial companies.

If you have an e-commerce business, we recommend you go with the global payments ecosystem, as it’ll allow you to accept the following payment modes:

- Digital wallets: Apple Pay, Google Pay, Microsoft Pay, etc

- Buy now pay later services: Afterpay and Klarna

- Local and international in-hand payments

- ACH Credit, ACH debit, and wire transfers

- Credit and debit cards: American Express, Mastercard, Visa, Discover, etc.

Stripe operates in over 30 countries and processes payments in more than 135 currencies. So, security and reliability will never be an issue. You can also do this by making it part and parcel of your business strategy in many ways. Mostly, you’ll find that e-commerce store builders such as Shopify or Woocommerce are integrated with Stripe natively.

Moreover, you can even use pre-built integrations to link your sites to Stripe and bill customers through the online invoice and shared link. Also, you can’t forget about the Stripe Terminal for POS operations.

Also read: ClickFunnels vs Shopify: Choose the Right E-Commerce Platform

Shopify Payments Features Overview

Shopify payment is built on similar technology to Stripe, but some functions might differ slightly. You get it with all Shopify plans. Also, if you want to avoid third-party transaction fees, it’s your only option.

Shopify Payment allows you to take payment from your customers online and offline through Shopify stores or Shopify POS tools. You can integrate with more than 100 payment providers; Shopify Payments supports 22 countries right now and gives you the option to choose from 130 countries. You can opt for it if you want something that’s simple and fast while allowing you to accept payments using the following payment gateways:

- Credit and debit cards such as Visa, MasterCard, American Express, Discover, etc.

- Digital Wallets like Google Pay, Microsoft Pay, Apple Pay, etc.

- Local and international Payments

- Manual payment from card reader tools and terminals

- Online Payment Services like PayPal.

When doing online transactions, our main concern is security, right? Thankfully, both Shopify Payments and Stripe have done exceptionally well in terms of security, as both are PCI-compliant.

It means you get powerful fraud protection features & fraud filters. However, you can only use Shopify Payments using the Shopify e-commerce platform. It’s an Integral part of Shopify, and you can use it with various Shopify options, such as:

- Your Shopify Checkout Page.

- Shopify purchase links

- Shopify-approved terminals, card readers, and POS tools

- Social media integrated sales channels.

Also read: Do You Need a Business License to Sell on Shopify?

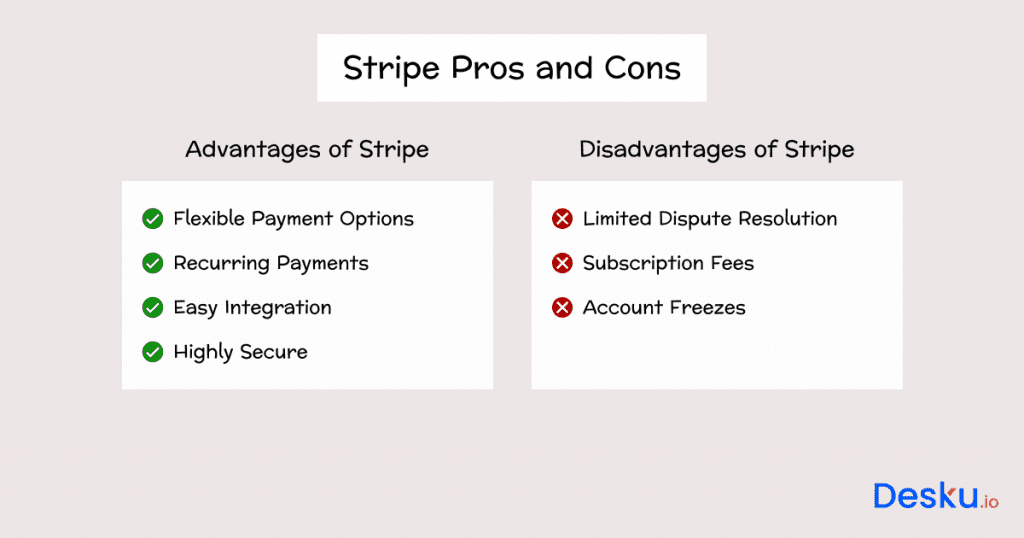

Stripe Pros and Cons

We know that no tool is perfect in every aspect, and neither is Stripe. But you can still check whether they fulfil your specific primary requirements.

So, let’s start with the positives and negatives of Stripe first.

Pros

1). Flexible Payment Options

Stripe payment platform offers you many different types of payment methods. For example, credit cards, debit cards, or even digital wallets (Apple Pay, Google Pay, etc). As a business owner, you can receive payment from customers across the globe through more than a hundred and thirty-five currencies! This huge payment variety, while supporting these many nations, proves that Stripe can be your on-go choice to receive payments without any headaches.

2). Recurring Payments

You get subscription billing models. It means you can conveniently receive recurring payments from customers monthly or annually without manually authenticating every payment. This is awesome if you sell subscription-based services or tools.

3). Easy Integration

You can consider the ease of use of Stripe within websites and mobile applications as one of Stripe’s biggest advantages. This provides various APIs, which are supportive parts of Stripe, for developers to seamlessly incorporate payment processing into their presently used software.

4). Highly Secure

Stripe is PCI compliant. It means Stripe abides by rigid data security regulations to protect customers from fraud.

Cons

1). Limited Dispute Resolution

Due to the lack of a built-in dispute management system in Stripe, you’ll have to handle any disputes manually. Now, it might take a lot of time and isn’t very cost-effective either. However, you can integrate it with a platform like Desku to handle disputes more efficiently.

2). Subscription Fees

If your transaction volume is high, transaction fees pile up quickly in Stripe. Fortunately, Stripe is very transparent in this matter, and you don’t have to worry about being charged extra due to hidden charges.

3). Account Freezes

Stripe can freeze your account without prior information if it detects fraudulent activity or violation of terms. It might temporarily hold your services until it’s resolved.

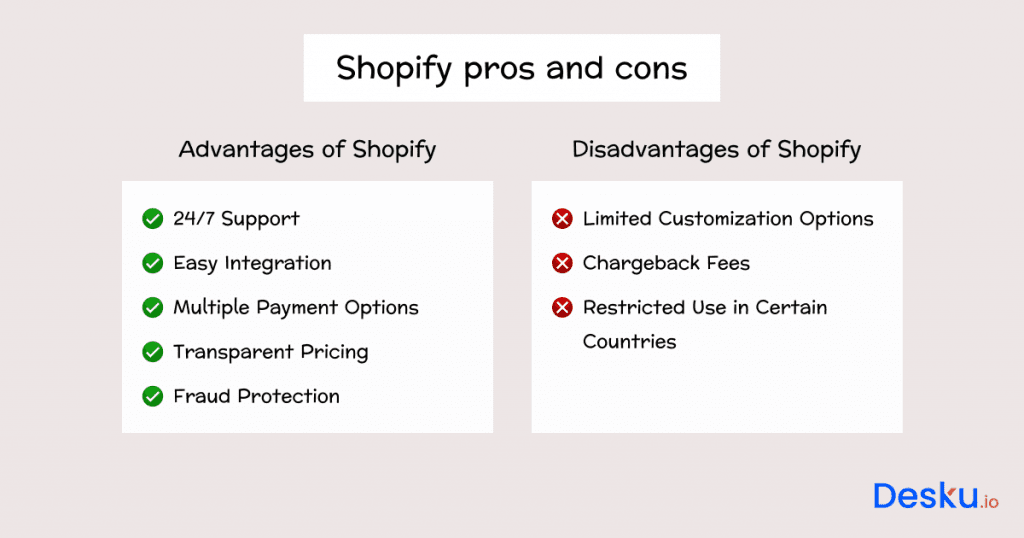

Shopify Pros and Cons

Shopify payments look like an enticing option with their many added benefits, so let’s also look at their positives and negatives.

Pros

1). 24/7 Support

What if your customers are regularly purchasing from your online store, but you face a sudden technical glitch? In such cases, proper support is crucial to make sure your service is always running smoothly. Shopify doesn’t cut any corners by providing 24/7 support. You can contact them by email, phone, and even live chat.

2). Easy Integration

Since Shopify payment is from Shopify itself, it integrates smoothly with its other features.

It means you can easily manage your online store. You can check order progress and accept payments on time. Besides that, you can track inventory from a single place.

3). Multiple Payment Options

If you’re going with Shopify, you can receive payments from major payment services. There won’t be limitations in terms of payment methods as you get all options from debit and credit cards and even digital wallets (Google Pay, Apple Pay, and PayPal Express checkout).

4). Transparent Pricing

Stripe Shopify payment also has transparent pricing, so there are no worries about hidden fees. Your specific transaction fees are based on your Shopify plan. They range between 2.4% + 30 cents per transaction to 2.9% + 30 cents per transaction.

5). Fraud Protection

You’ll never have to worry about fraudulent transactions or chargebacks with Shopify payments, as it has built-in fraud protection features.

Cons

1). Limited Customization Options

With Shopify Payment, you don’t have as many customization options as Stripe, so you are limited in terms of customization.

2). Chargeback Fees

You get fraud protection features with Shopify Payments, but in case of any chargeback disputes, you have to pay a chargeback fee, whether you win the case or not.

3). Restricted Use in Certain Countries

With Stripe, you can accept payments from around the world in 135 currencies, But the Shopify payment processor is only available in limited countries. So check the list of available countries on their site to see if countries you want to do business in are supported or not.

Conclusion: Stripe vs Shopify Payments

Stripe and Shopify Payments have their strengths, but in the end, everything is based on your business needs. However, Shopify Payments is often easier to handle and compatible with Shopify, but not as versatile as Stripe.

On the other hand, Stripe provides more personalization and would work best for companies with specialized or intricate payment requirements, which could be cumbersome to implement and maintain.

Payment processing is an important function in your internet business, but it is merely a single part of the puzzle. The other important aspect is excellent design, which may affect how people perceive and interact with your brand.

Also, while Stripe & Shopify payments handle your payment gateway, you can choose Desku to take care of your customer support needs.