Customer acquisition costs (CAC) can put a strain on your budget, but cutting them down is more achievable than you might expect. By fine-tuning your marketing strategies, keeping your current customers happy, and increasing customer lifetime value, you can effectively reduce your CAC while fostering growth.

In this guide, we will explore budget-friendly strategies, from enhancing your marketing campaigns to utilizing tools like Google Analytics. Whether you operate an online store or oversee a SaaS business, you’ll discover how to attract paying customers, improve retention, and create a sustainable customer base. Let’s get started!

What is Customer Acquisition Cost?

Customer acquisition cost (CAC) is the total amount a business spends to gain new customers. This important metric encompasses all sales and marketing activities, such as marketing campaigns, paid advertising, and various strategies, divided by the number of new customers acquired over a certain period.

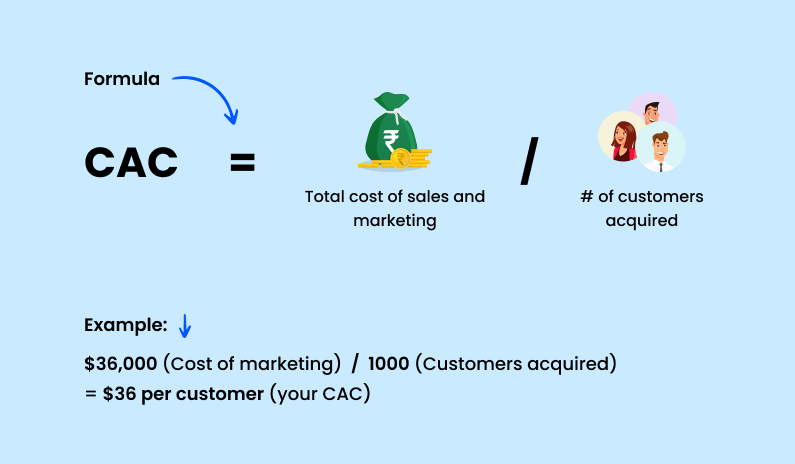

Here’s the formula for calculating CAC:

CAC = (total cost of sales and marketing) / (# of customers acquired)

Understanding your customer acquisition cost is essential for evaluating the effectiveness of your marketing strategies. A high CAC may suggest that your sales funnel or marketing channels require improvement. Reducing CAC allows for better resource allocation, promoting sustainable growth and increasing customer lifetime value.

For instance, an online retailer using Google Ads might monitor its CAC to determine the cost of acquiring each new customer. If the average CAC is excessively high, the retailer can enhance its landing pages, adjust its search campaigns, or invest in social media marketing to lower costs.

Monitoring CAC not only helps pinpoint weaknesses in your customer acquisition approach but also reveals opportunities to enhance conversion rates and improve customer satisfaction.

Why Reducing Customer Acquisition Costs is Crucial for Your Business

Cutting down on customer acquisition costs (CAC) is not merely about saving money; it’s essential for boosting profitability and ensuring sustainable growth. When acquisition costs are high, they can significantly impact your budget, leaving less available for enhancing your value proposition or improving customer satisfaction.

Here’s why it’s important to lower CAC:

Improves ROI on Marketing Spend

Every dollar invested in marketing should lead to generating leads and converting potential customers into actual buyers. Reducing CAC makes your marketing campaigns more cost-effective, enabling you to allocate resources more efficiently and achieve better marketing outcomes.

Increases Customer Lifetime Value

A high CAC combined with a low customer lifetime value can negatively affect profitability. By concentrating on retaining current customers through loyalty programs, personalized experiences, and proactive customer relationship management, you can lessen the reliance on acquiring new customers and maximize revenue from your existing customer base.

Supports Business Scalability

For businesses such as SaaS companies and e-commerce stores, managing acquisition costs is crucial for scalability. As you broaden your marketing channels and draw in more new customers, a lower Customer Acquisition Cost (CAC) facilitates steady growth without significantly increasing expenses.

Reduces Dependence on Paid Media

Paid advertising, including Google Ads and social media platforms, can be expensive. By integrating organic strategies like content marketing, word-of-mouth marketing, and user-generated content, businesses can lessen their reliance on paid methods to attract a larger customer base.

Shortens the Sales Cycle

A reduced CAC often aligns with a more efficient sales funnel and a shorter sales cycle, allowing you to convert potential customers more quickly. This is particularly vital for small and medium-sized businesses (SMBs) with limited budgets that require prompt results.

By decreasing your customer acquisition costs, you establish a more efficient, scalable, and profitable business model. The next step is to explore actionable strategies to achieve this.

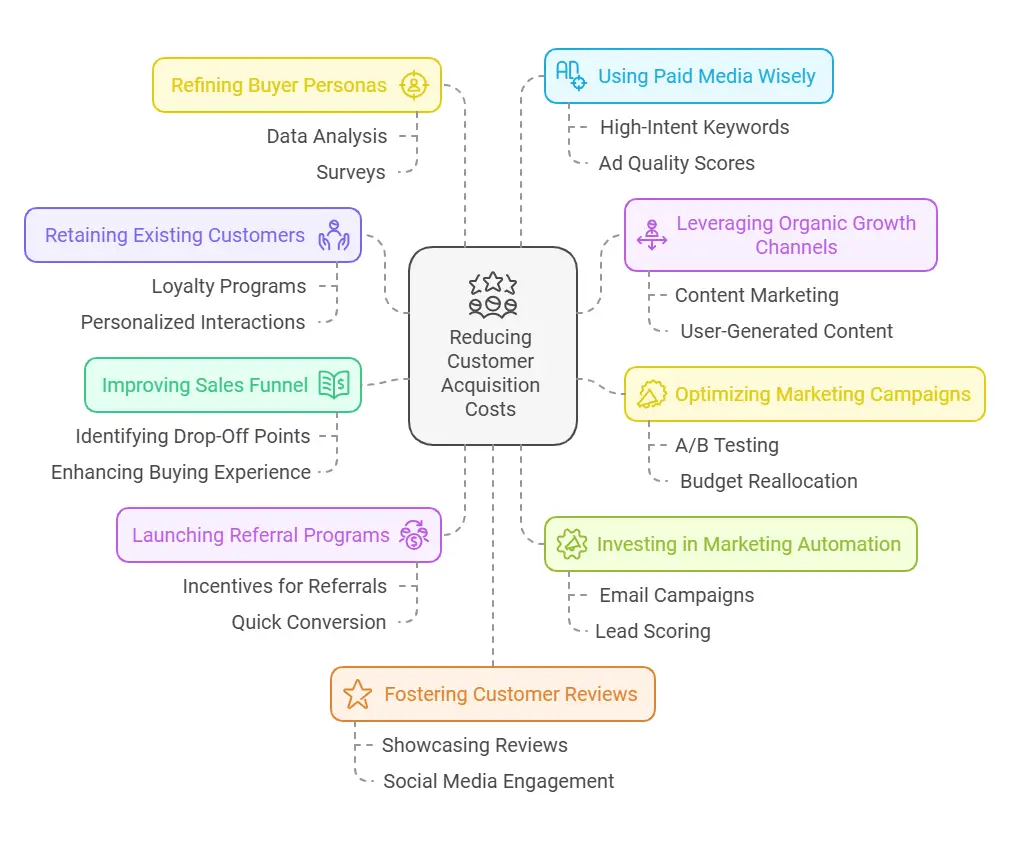

How to Reduce Customer Acquisition Costs

Reducing customer acquisition costs (CAC) involves a combination of strategic planning, data analysis, and focused execution. Here are some practical strategies to help you lower costs while effectively converting and attracting more customers.

1. Focus on Retaining Existing Customers

Keeping existing customers is much more cost-effective than acquiring new ones. Implementing loyalty programs, proactive customer relationship management, and personalized interactions can enhance customer satisfaction and boost customer lifetime value. By retaining customers, you not only decrease churn but also foster word-of-mouth marketing, which can attract new customers at a lower cost.

2. Leverage Organic Growth Channels

Organic channels such as content marketing and social media are excellent for generating leads without significant costs. Develop blog posts, videos, and guides that tackle your audience’s challenges. Incorporate user-generated content to build trust with potential customers while keeping initial expenses low.

3. Optimize Marketing Campaigns and Channels

Monitor your Google Analytics data to pinpoint underperforming marketing channels. Utilize A/B testing to refine landing pages and enhance conversion rates. Reallocate budgets to high-performing platforms and cut down on ineffective spending. A well-optimized search campaign or email marketing funnel can greatly reduce customer acquisition costs.

4. Improve Your Sales Funnel

Streamlining the sales funnel can help shorten the sales cycle and boost successful conversions. Identify where customers drop off and address any issues in their interactions at each stage. By enhancing the buying experience for potential customers, you can secure more paying customers with less effort.

5. Launch a Referral Program

Referral programs leverage the power of word-of-mouth marketing. Happy customers are your best advocates, and providing incentives for referrals can lower your average customer acquisition cost. Leads generated through referrals often convert more quickly, which helps reduce your upfront expenses.

6. Invest in Marketing Automation

Automating repetitive tasks such as email campaigns and lead scoring can save both time and resources. Tools like CRM platforms can optimize your sales and marketing efforts, track consumer preferences, and deliver personalized experiences. This approach minimizes manual workload and creates a more efficient customer acquisition strategy.

7. Refine Your Buyer Personas

Having a clear understanding of your target audience ensures that your marketing efforts resonate with the right people. Utilize data from Google Analytics, surveys, and customer interactions to develop detailed buyer personas. This level of precision helps reduce wasted spending on irrelevant marketing channels and attracts the right paying customers.

8. Use Paid Media Wisely

Paid media, such as Google Ads and social media marketing, should enhance your organic efforts rather than overshadow them. Concentrate on high-intent keywords, boost your ad quality scores, and keep a close eye on performance to achieve cost-effective outcomes.

9. Foster Customer Reviews and Testimonials

Positive reviews help build trust and draw in potential customers without incurring significant advertising expenses. Showcase reviews on your online store, social media pages, and email campaigns to drive successful conversions.

By applying these strategies, you can reduce your customer acquisition costs while establishing a solid foundation for long-term marketing success.

Case Studies: Success Stories of Reduced Customer Acquisition Costs

Real-world examples can provide valuable insights for lowering customer acquisition costs (CAC). Here are a few success stories that showcase how businesses achieved cost-effective growth:

1. SaaS Company Optimizes Paid Campaigns with Google Analytics

A mid-sized SaaS company found that their Google Ads campaigns were not performing well. By analyzing data from Google Analytics, they pinpointed high-cost, low-performing keywords. The team shifted their marketing budget to focus on high-intent keywords and improved their landing pages. As a result, they achieved a 30% reduction in CAC and a 15% increase in successful conversions within three months.

2. E-Commerce Brand Boosts Customer Retention with Loyalty Programs

An online store faced challenges with high churn rates and increasing acquisition costs. They launched a tiered loyalty program that offered discounts and rewards for repeat purchases. This initiative enhanced customer satisfaction, reduced churn by 20%, and significantly increased customer lifetime value. With more revenue from existing customers, the brand became less reliant on acquiring new customers, which lowered their CAC by 25%.

3. SMB Leverages Referral Programs for Cost-Effective Growth

A small business that specializes in subscription boxes set up a referral program using ReferralCandy. By offering discounts to existing customers for successful referrals, they created a consistent influx of new customers. Leads generated through referrals had a 50% higher conversion rate compared to other marketing channels, allowing the business to reduce its CAC by 40% over six months.

4. Customer Support Team Uses Marketing Automation for Lead Nurturing

A growing SaaS company’s customer support team utilized HubSpot to automate email campaigns aimed at leads who abandoned free trials. Personalized follow-ups, guided by insights from their CRM, led to increased trial-to-paid conversion rates. This strategy reduced the company’s CAC by 18% while also shortening the sales cycle.

5. Retailer Expands Organic Growth Through User-Generated Content

A retail brand invited customers to post photos and reviews of their purchases on social media. By utilizing user-generated content, the retailer experienced a boost in trust and engagement from prospective buyers. This organic approach allowed them to lessen their dependence on paid advertising, resulting in a 20% decrease in customer acquisition costs.

These examples demonstrate that refining marketing strategies, improving customer retention, and using effective tools can significantly lower acquisition costs.

Conclusion

Cutting down on customer acquisition costs (CAC) is crucial for building a sustainable and profitable business. By focusing on retaining current customers, fine-tuning your marketing strategies, and utilizing tools like Google Analytics and marketing automation platforms, you can reduce customer acquisition costs while enhancing your overall growth potential.

The secret is to strike a balance. Combine organic tactics such as content marketing and user-generated content with well-optimized paid media efforts. Connect with your existing customers through personalized experiences and loyalty programs to increase customer lifetime value and encourage word-of-mouth marketing.

Keep in mind that every effort to lower acquisition costs—whether it’s through smarter resource allocation, optimizing the sales funnel, or refining buyer personas—brings you closer to a more efficient and scalable business model. With the strategies outlined here, you’re well-prepared to achieve results while keeping expenses in check.

Frequently Asked Questions (FAQs)

1. Why is reducing customer acquisition costs important?

Reducing customer acquisition costs is crucial for several reasons. It enhances profitability, boosts marketing effectiveness, and supports sustainable growth. Additionally, it enables businesses to use their resources more efficiently, which can increase customer lifetime value and overall operational efficiency.

2. How can I lower my CAC without sacrificing quality?

To lower your customer acquisition cost without compromising quality, concentrate on cost-effective methods such as content marketing, enhancing conversion rates, and focusing on customer retention. Utilizing tools like Google Analytics and marketing automation platforms can also streamline your sales processes and minimize unnecessary expenses.

3. What role does customer retention play in reducing CAC?

Customer retention significantly contributes to reducing acquisition costs. Keeping existing customers is generally much cheaper than attracting new ones. Implementing loyalty programs, effective customer relationship management, and offering personalized experiences can help decrease churn rates and enhance customer lifetime value, which in turn reduces the need for new customer acquisitions.

4. How can I use referral programs to reduce acquisition costs?

Referral programs can be an effective way to cut acquisition costs. They leverage satisfied customers to attract new ones through word-of-mouth marketing. This approach is cost-effective since referrals typically convert more quickly and at a lower cost compared to leads generated from paid advertising or other marketing methods.

5. What are the best tools for monitoring and reducing CAC?

To monitor and reduce customer acquisition costs, consider using the following tools:

Google Analytics for tracking website performance and identifying traffic sources.

CRM platforms like Salesforce to enhance customer interactions.

Marketing automation tools such as HubSpot for nurturing leads and managing campaigns.

Referral program platforms like ReferralCandy to harness the power of customer advocacy.

- About the Author

- Latest Posts

Gaurav Nagani was the Founder of Desku, an AI-powered customer service software platform.

- Email Management: Best Strategies, Tools & Tips for SaaS and Ecommerce

- Shared Inbox Guide: Definition, Benefits, Tools & Best Practices 2025

- LivePerson Pricing Exposed: What They Don’t Show You on Their Website

- Automate Customer Support with AI A Practical Guide

- Desku vs UsePylon: Which One Scales Better for Startups?